- Staking Insider

- Posts

- From Bangkok Condo and Scrappy Excel Spreadsheet to Leading in Accurate Staking Data

From Bangkok Condo and Scrappy Excel Spreadsheet to Leading in Accurate Staking Data

A Journey Through Staking Rewards and the Evolution of Our Newly Launched Staking Calculator (Beta)

Investors are losing out on ~$15.9 billion in rewards in 2023 alone simply because they don't factor in staking returns when deciding which crypto assets to buy. Over 60% of investors make this mistake, leading to faulty portfolio planning and missed investment opportunities.

I would have 805 ATOM ($12k) MORE today if I started staking in 2020 with only $4.5k at the time. So I missed out thinking I was too late, not factoring in the long-term effect of staking into my analysis.

I also didn’t know which provider to choose for staking my crypto. Like most others, I just spent around 30 minutes selecting a provider each time, but still felt uncertain about the potential rewards. There wasn't much information available on how to choose the right provider and from our research, stakers miss out on up to 20% higher returns and a significantly more impactful contribution to network security if they choose the wrong provider.

This is also alarming - only 38% of all stakeable crypto tokens are actually being staked. Plainly, investors are leaving low-risk money on the table.

Let me share with you the mistakes I made so that you can avoid repeating them.

Back in 2014, I was mining Bitcoin in a small Bangkok condominium and feeling frustrated with the high capital requirements needed for success. It just didn't feel like the true crypto spirit that I had originally signed up for. This was around the time of the ICO craze, with many new shiny tokens emerging. One of these was Cosmos, which was expected to be released soon.

So I did a lot of research, owned a lot of shitcoins, and then discovered how simple it was to stake tokens with low requirements.

At first, I thought it was too late to start staking, but then I decided to give it a shot anyway.

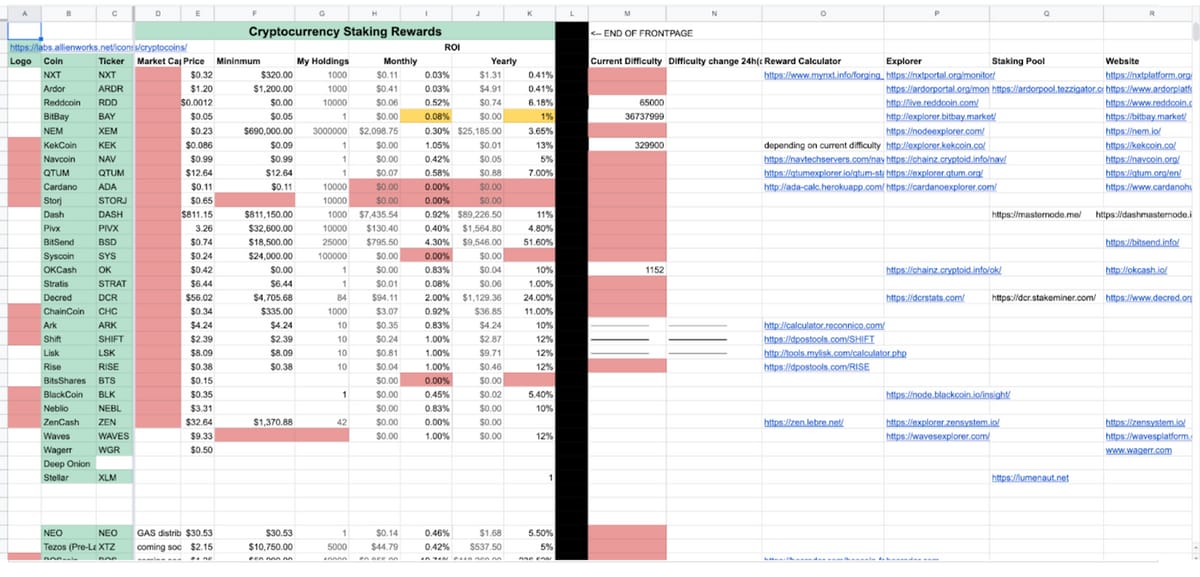

I began using Excel spreadsheets to calculate my staking rewards, and it was an incredibly tedious process. However, this was the beginning of our journey to develop the first version of Staking Rewards. At that time, I recognized the lack of available data on staking and realized that others were definitely experiencing the same challenges. So, I collaborated with my brother Jannik to build StakingRewards.com, which we launched in early 2018.

No More Best Guesses or Complex Spreadsheets. Try the Staking Calculator (Beta) here.

Fast forward to today, and we are proud to be the leader in staking data and information.

Believe me when I say that you don't want to miss out on great investment opportunities simply because you didn't consider the power of staking. I learned this lesson the hard way when I missed out on ATOM due to underestimating the potential returns from staking.

So, where do you begin? Imagine being able to seamlessly integrate staking returns into your investment decision-making and portfolio planning. Or easily optimize your staking setup to earn higher rewards while also contributing to network security… without the spreadsheets.

With the right information and tools, this is all possible.

In just 5 minutes, you can gain insights into optimizing your staking strategy and drastically increasing long-term returns.

The global staking market cap has already surpassed $400 billion and continues to rise, with over 7 million staking wallets currently in use. We are on the brink of broad retail and institutional adoption, as Proof of Stake dominance grows to make up all relevant L1 blockchains (except for Bitcoin). Meanwhile, DeFi is also becoming an increasingly dominant force.

Investors are projected to earn over $8.2 billion in staking rewards in 2023 alone, with various blockchains offering an average weighted yield of 7.31% per year. This is not bad at all compared to the average dividend yield of the S&P 500 Index, which has been around 1.05% in the last year.

This means that we’re in the golden age of crypto and we have never been more early.

As more investors, including risk-averse institutional investors, enter the DeFi space, the incentive for high staking rewards will decrease. Therefore, we can expect staking yields to become more comparable to those seen in traditional markets such as the stock market.

Take a look at this table showing the most popular staked cryptocurrencies in 2023.

Top 10 PoS Assets by Staking Market Cap, Data Captured on StakingRewards.com

How can you calculate staking rewards and estimate future earnings, and how do you choose the best staking provider for your crypto assets?

Meet the Staking Calculator (Beta). No more best guesses or complex spreadsheets. Here’s a FREE TOOL that can help you optimize your staking strategy and portfolio.

There are many questions that you’ve probably already considered. Should you stake or not? Which provider should you choose? How can you project rewards in the face of changing prices and rates? And should you compound or sell your rewards?

Our Staking Calculator can help you answer all of these questions by measuring the long-term effects of staking for over 150 assets and their hundreds of providers. Including all of the most popular staked crypto shown in the above table.

Here are some of the key features available on the Staking Calculator:

Select and compare any asset

Choose and compare any provider

Estimate profitability of running your own validator by selecting solo staking

View earnings in either dollar or token amounts

Analyze strategies with interactive charts

Evaluate long-term impact by selecting up to 10 years

Create custom price scenarios based on your expectations

Explore network assumptions to see potential rewards if metrics were to change, such as if more or less were being staked

It also pulls raw data from each blockchain every two hours, helping you to estimate staking returns accurately and visually showing the impact of compounding versus non-compounding, returns based on different staking ratios, and estimated rewards for potential price changes.

If you're holding onto idle crypto assets and considering staking them, it can be challenging to accurately predict your potential earnings and decide if staking is worth it.

Let's say you have 50 ETH and are interested in staking. Using our Staking Calculator, you can experiment with different scenarios and price changes over the selected staking period to see how much you could potentially earn compared to not staking.

Or maybe you’ve just bought $20,000 worth of ATOM to stake for the next 2 years. If you’re using a spreadsheet, you’re definitely going to struggle to project your earnings for staking in light of anticipated price fluctuations. On the calculator, all you have to do is select Cosmos and play around with the fields to, once again, see how much you could potentially earn compared to not staking.

It offers unlimited possibilities.

Thousands of people are missing out on this opportunity because they don't fully understand staking or how to optimize their staking setup.

That's why I highly recommend using the Staking Calculator to better plan your investments and ensure you're earning the highest possible staking rewards.

This is an invaluable tool for any investor looking to incorporate staking into their portfolio.

🔗 Feedback, bugs, features and questions: https://discord.gg/t2wVJv3e

Reply